|

E-CASH PAYMENT SYSTEM 1 |

| << VIRTUAL PIN PAYMENT SYSTEM |

| E-CASH PAYMENT SYSTEM 2 >> |

E-COMMERCE

IT430

VU

Lesson

26

E-CASH

PAYMENT SYSTEM

A

company, DigiCash, has pioneered the

use of electronic cash or e-cash.

Anonymity of the buyer is the key

feature

of this system. There are three

participants in it, namely, buyer,

merchant and bank. Both,

symmetric

and

asymmetric type of cryptography is used in this

system.

Buyers

and merchants, both, have

accounts in the E-cash bank. Buyers

withdraw coins against

their

account

and store them in e-cash wallet

software (Cyber wallet) on their

computer. Cyber wallet stores

and

manages

coins and records every

transaction. Merchant forwards coins to

e-cash bank which ensures

that

these

have not already been

spent and credits the

account of the merchant.

E-cash

Coins

The

currency used in this payment

system is called an e-cash

coin or simply coin. A coin

consists of three

elements

or parts - serial #, key version

and serial no. signed by the

secret or private key of a

certain

denomination

of the e-cash bank. In other words, a

coin of one dollar would

consist of the following:

Coin =

Serial#, keyversion, {Serial #}SK bank's $1

key

Each

coin has a unique value,

partly minted by the client

and partly by the e-cash

bank.

Minting

of the coin

A long

serial no. is randomly

generated by the client's Cyber wallet in

order to mint a coin. This

serial no. is

blinded,

which means that it is

multiplied with a blinding

factor "r" and sent to the

e-cash bank for

signatures.

Thus, the e-cash bank cannot see the

serial no. it is signing.

Key version (corresponding public

key of

the bank) is also part of the coin, and

is sent usually at the time of account

opening. An e-cash bank

may

have 1 dollar signature, 5

dollar signature or 10 dollar

signature etc. If the client

wants to mint a coin

of

2

dollars then e-cash bank

would use its private or

secret key of 2 dollars to

sign the serial no.

How

bank signs blindly?

Cyberwallet

generates a serial # and a

blinding factor `r'. This

blinding factor "r" is only

known to the client.

It is

used in the following mathematical

expression which is sent to the bank

for signatures.

Serial

# . re2 (mod m)

Public

key of the bank consists of modulus

`m' and a no. `e'. Bank

signs with its secret

key of 2 dollars (d2)

such

that:

(Serial

#. re2)d2(mod

m)=Serial#d2.re2d2(mod m)

(Serial

#. re2)d2(mod

m)=Serial#d2.r(mod

m)

The

product of e2 and d2 cancel

out each other due the

property of inverse relationship of keys.

Bank

cannot see

serial # it is signing since it

does not know `r'.

The expression "Serial#d2.r(mod m)" is sent

back

by the bank to the

client, who divides it with "r" to get

the third part of a valid 2

dollar coin as

follows:

Serail#d2.r(mod m)/r=Serial#d2(mod

m)

Thus,

minting of a 2 dollar coin is

completed. In a similar fashion one

can withdraw or mint coins

of

different

denominations. E-cash bank signs the

serial nos. and debits the

account of the client. A client

must

maintain

his account with the bank.

So, if a client has $ 50 in

his account with the e-cash

bank and requests

for

the coins of a total value of $

10, the amount left in his

account after bank's signatures on the

serial nos.

would

be $ 40.

116

E-COMMERCE

IT430

VU

Working

of the E-cash

model

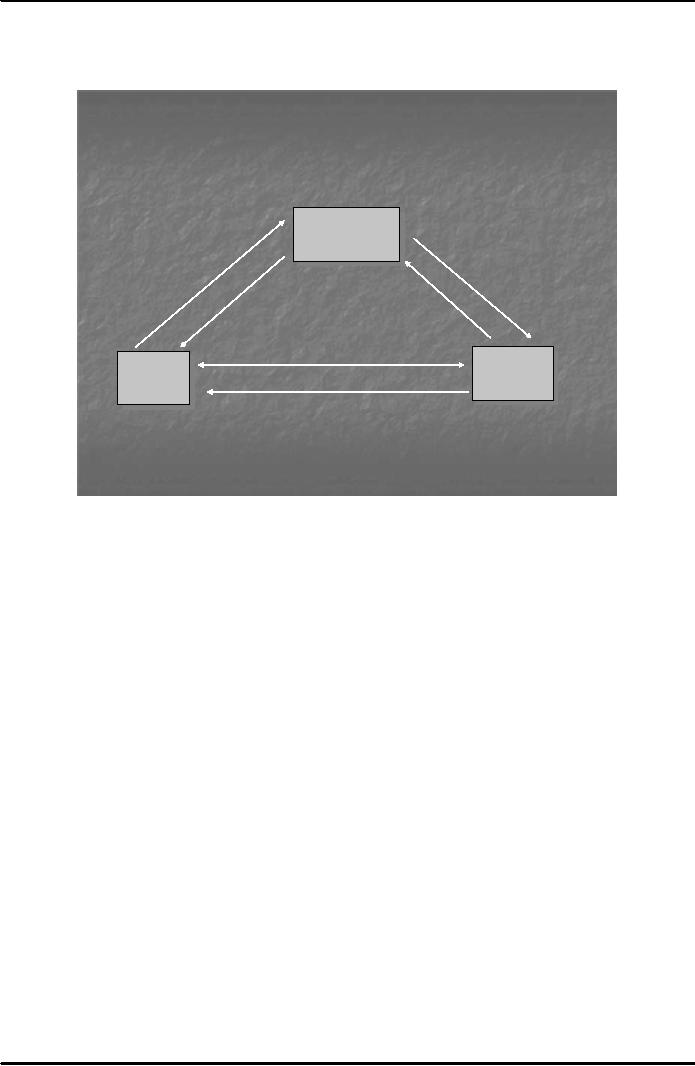

Fig.

1 below shows the e-cash

model:

E-cash

Model

� signs

coins

� user

accounts

�

database

EccashBaank

E ash

B

nk

Withdraw/

Deposit

Valid

indication

coins

New

Coins,

Validate

statement

+deposit

coins

Pay

coins

Meerchant

M rchant

Clileent

C i nt

Softtware

Sofware

Waalleet

Wl lt

Goods,

Receipt

� sells

items

� stores

coins

� accepts

payments

� makes

payments

� makes

payments

� accepts

payments

Fig.

1

Client

wallet or cyber wallet can generate

serial nos., store coins,

make and accept payments. It

can

withdraw

(get the coins minted) from

the e-cash bank, and deposit coins at the

payment stage to the bank.

E-cash

bank can issue new coins

and send account statement

to the client. On the merchant side,

there is

special

merchant software. Thus, a

merchant can sell items,

accept payments from clients

and also make

payments.

E-cash bank signs the serial

nos., maintains accounts of the

client and the merchant and

also

maintains

a database in which the serial

nos. of all such coins

sent for payment are

recorded. The client

makes

the payment to the merchant for the

items bought. The payment is

made through e-cash coins.

Note

that

these coins are earlier

got minted with the help of

e-cash bank and remain

stored in the cyber wallet.

The

coins are encrypted with the

public key of the bank and

are forwarded to the merchant for

onwards

deposit

to the bank. The merchant cannot,

therefore, view these coins.

E-cash bank decrypts the

coins

using

its corresponding private key

and compares the serial nos.

, thus revealed, with its

database of spent

coins

to check the validity of the coins. If a

revealed serial no. is not

contained in the database, it proves

that

the

coin is valid and unspent.

The bank then sends the

valid indication to the merchant

and adds that

particular

serial no. in its database

to prevent any chance of its

being consumed in the future. The

merchant

then

sends the goods and receipt

of payment to the client.

117

Table of Contents:

- E-COMMERCE

- WHAT IS A NETWORK

- HOW MANY CLASS A, B, C NETWORKS AND HOSTS ARE POSSIBLE

- NETWORKING DEVICES

- BASICS OF HTML 1

- BASICS OF HTML 2

- TEXT BOXES, CHECK BOXES, RADIO BUTTONS

- FRAMES AND IMAGES IN HTML

- TAG ATTRIBUTES, SOUNDS FILES, ANIMATIONS

- STYLE SHEETS 1

- STYLE SHEETS 2

- SOME USEFUL STYLE SHEETS PROPERTIES

- JAVA SCRIPTING 1

- JAVA SCRIPTING 2

- JAVA SCRIPTING 3

- JAVA SCRIPTING AND XML

- CLIENT AND SERVER SIDE PROCESSING OF DATA

- APPLETS, CGI SCRIPTS

- MAINTAINING STATE IN A STATELESS SYSTEM

- INTEGRATION WITH ERP SYSTEMS

- FIREWALLS

- CRYPTOGRAPHY

- HASH FUNCTION AND MESSAGE DIGEST

- SYMMETRIC KEY ALGORITHMS

- VIRTUAL PIN PAYMENT SYSTEM

- E-CASH PAYMENT SYSTEM 1

- E-CASH PAYMENT SYSTEM 2

- SECURE SOCKET LAYER (SSL)

- E-BUSINESS: DISADVANTAGES OF E-BUSINESS

- E-BUSINESS REVENUE MODELS

- E-MAIL MARKETING

- CUSTOMER RELATIONSHIP MANAGEMENT (CRM)

- META INFORMATION

- DATA MINING

- CONFIDENCE AND SUPPORT

- ELECTRONIC DATA INTERCHANGE (EDI)

- PERSONAL FINANCE ONLINE

- SUPPLY CHAIN

- PORTER’S MODEL OF COMPETITIVE RIVALRY

- BARRIERS TO INTERNATIONAL E-COMMERCE

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 1

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 2

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 3

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 1

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 2