|

VIRTUAL PIN PAYMENT SYSTEM |

| << SYMMETRIC KEY ALGORITHMS |

| E-CASH PAYMENT SYSTEM 1 >> |

E-COMMERCE

IT430

VU

Lesson

25

VIRTUAL

PIN PAYMENT SYSTEM

A

Virtual PIN can become

compromised as a result of eavesdropping

and bogus purchases are

possible

before it is

blacklisted. Stolen credit card number

can also be used to set up

Virtual PIN associated

with

email

addresses controlled by the attacker to

carry out bogus

transactions. After every 90

days buyer's credit

card

account is billed for the

charges that have

accumulated and the merchant's

account is credited

accordingly.

FV does accounting for

merchant and buyer; therefore, it

takes a commission per

transaction

according

to its policy.

Advantages

and disadvantages

Simplicity

and no encryption is the biggest

advantage of this payment system,

which means that no

special

software

is needed at the frond end.

This payment system is good

for low-cost information

items.

Therefore, it is

suitable for buying online

articles/journals/music etc. where the

cost of the items is

not

much.

In that eventuality, only sales

are lost rather than actual financial

loss to the merchant if there is

a

fraud. In

other words, only some

extra copies of the information

items are made in case of a

fraud. On the

other

hand merchant is exposed to much

greater financial loss if the

purchase relates to the actual

physical

goods.

One of the disadvantages of this payment model is

that pre-registration of the buyer and

the

merchant

with FV is mandatory in this set up.

Moreover, maintaining a bank account (in

case of merchant)

and

having a credit card (in case of a buyer)

is also essential part of this

system. One can say that

the

merchant

side is less secured in the

transaction because the goods

are delivered by the merchant before

the

payment

is actually received. The

popularity of this payment system

declined after 1998 mainly because

of

the

introduction and development of

encryption based payment

mechanisms.

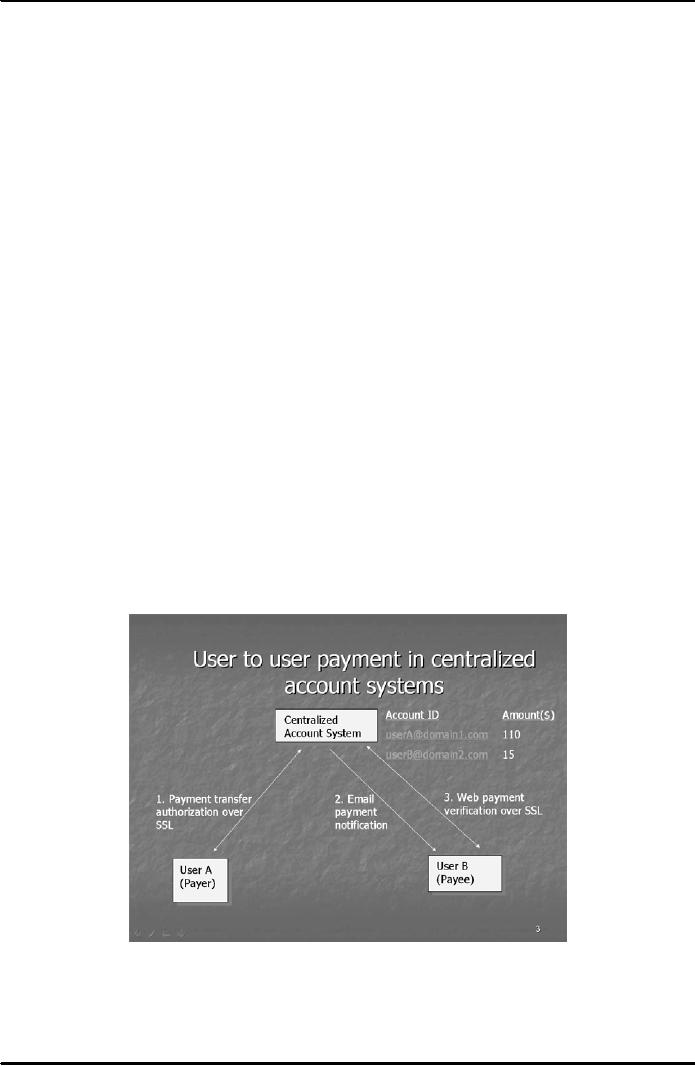

Centralized

Account Payment

Model

This

is a popular payment system on the

internet. In this both the payer (buyer)

and the payee

(merchant)

hold

accounts at the same centralized

on-line financial institution. Over 20

payment systems use

this

approach

e.g., PayPal, E-gold,

Billpoint, Cybergold, Yahoo! Pay Direct,

Amazon.com Payments etc.

This

model is

shown in Fig. 1 below:

Fig.

1

On-line

opening/funding of one's account is done

in a centralized bank using credit/debit

card or prepaid

cards.

To make payment an account

holder is authenticated using an

account identifier and a

password,

account

identifier of the payee and the

payment amount. All communication between

the user and the bank

is protected

using SSL

(Secure Socket Layer), which is an

encryption based protocol.

The chosen account

112

E-COMMERCE

IT430

VU

identifier

or the account ID is the one which is

unique within the system against

which the funds are

lying

in the

online bank. Normally, the unique email

addresses of the users are

chosen as account identifiers.

Payees

are notified by email of the

payment which they can

confirm by viewing their

account using SSL. A

payee

must open an account with the

online centralized bank to receive the

amount in case there is no

such

account

already. In some payment

systems which use this

approach a question may be sent to the

payee to

verify

his identity where the payer

is not sure of that. For

instance, Yahoo Paydirect

allows a payer-specified

question to be

sent to the so called email of the

payee. If the payer accepts the

answer as proof of the

correct

identity of the payee the money is

transferred otherwise the transaction is

cancelled.

The

centralized bank (depending upon its

policy) charges a transaction

fees either from the payer, or

payee

or

both on funding an account or

withdrawing funds from an account or

receiving payments by the

payee/merchant.

This payment model requires that

all participants must have

their account with the

same

central

payment system/bank. Note that the

payee can eventually withdraw the

money received in his

account

in the centralized bank through Automated

Clearing House (ACH).

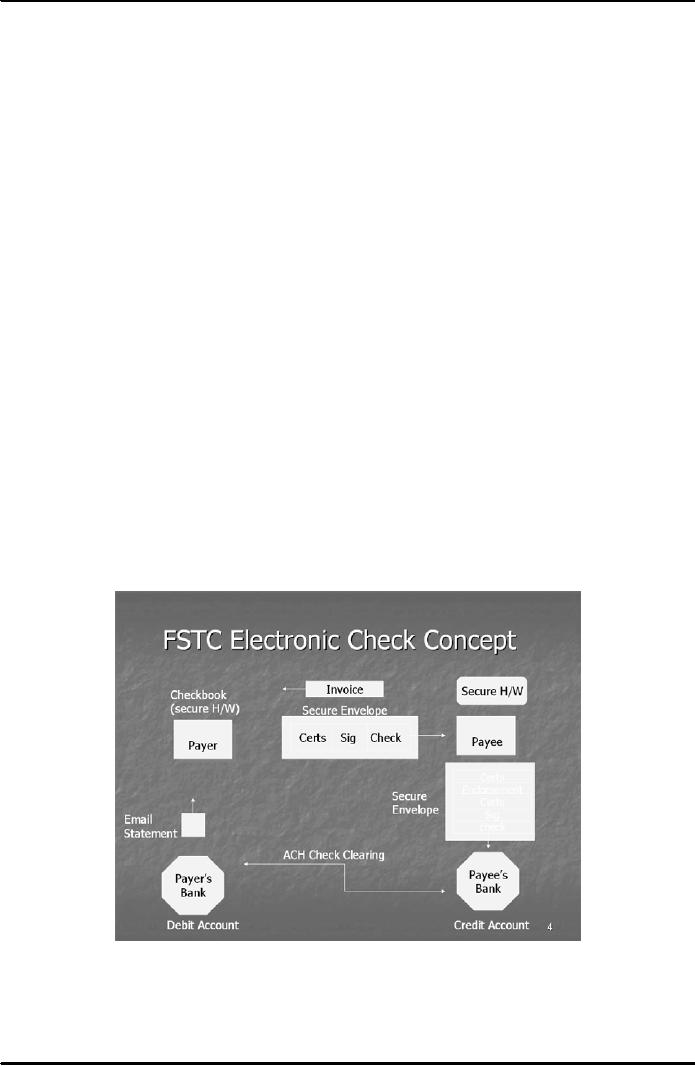

Electronic

Checks

Financial

Services Technology Consortium (FSTC) is a

group of U.S banks, research

agencies and

government

organizations formed in 1993. It

has introduced the concept of electronic

checks. An electronic

check

contains an instruction to the payer's

bank to make a specified payment to a

payee. Both,

symmetric

and

asymmetric type of cryptography is used in this

system. The payer and the

payee are issued

digital

certificates

in X. 509 standard format by

their respective banks.

These certificates are used

to verify the

digital

signatures on the check. A bank may

include account restrictions, maximum

check value, or

currencies

allowed by the bank in the certificate.

All

individuals capable of issuing electronic

checks will have an electronic

check book device. An

electronic

check

book device is a combination of

secure hardware such as a

smart card and appropriate

software. A

smart

card is usually the size of a credit

card having special software

loaded on it. Information

regarding

secret/private

key, certificate information and

register of what checks have

been signed/endorsed is

normally

stored in the smart card. Fig. 2 below

shows the working of an electronic check

in its typical

format:

Fig.

2

A

payer uses the electronic check

book device in his computer

system to generate a blank electronic

check

after

filling the information regarding amount,

date etc., and the electronic

check is digitally signed by

the

payer

through his private key. A

certificate issued by the payer bank authenticating

public key of the payer

is

also

attached with the electronic check. This

information is then sent to the

payee in a secure envelope

through

email. A secure envelop is created

when a user encrypts any

information with a symmetric

key, and

113

E-COMMERCE

IT430

VU

then

that symmetric key itself is

encrypted with the public

key of the receiver. Accordingly, the

payee, in this

case,

decrypts the secure envelop by first

retrieving the symmetric key (by

applying his private key),

and

then

using that symmetric key to

decrypt the information contained in the electronic

check. The payee

endorses

(counter-signs) the check using

some secure hardware device

such as a smart card and

forwards

the

check to the payee's bank in the form of

a secure envelop. The bank clears the

check with the help

of

traditional

Automated Clearing House (ACH).

Accordingly, the account of the payer is

debited and the

payee's

account is credited. The

banks send email statement

to the respective parties.

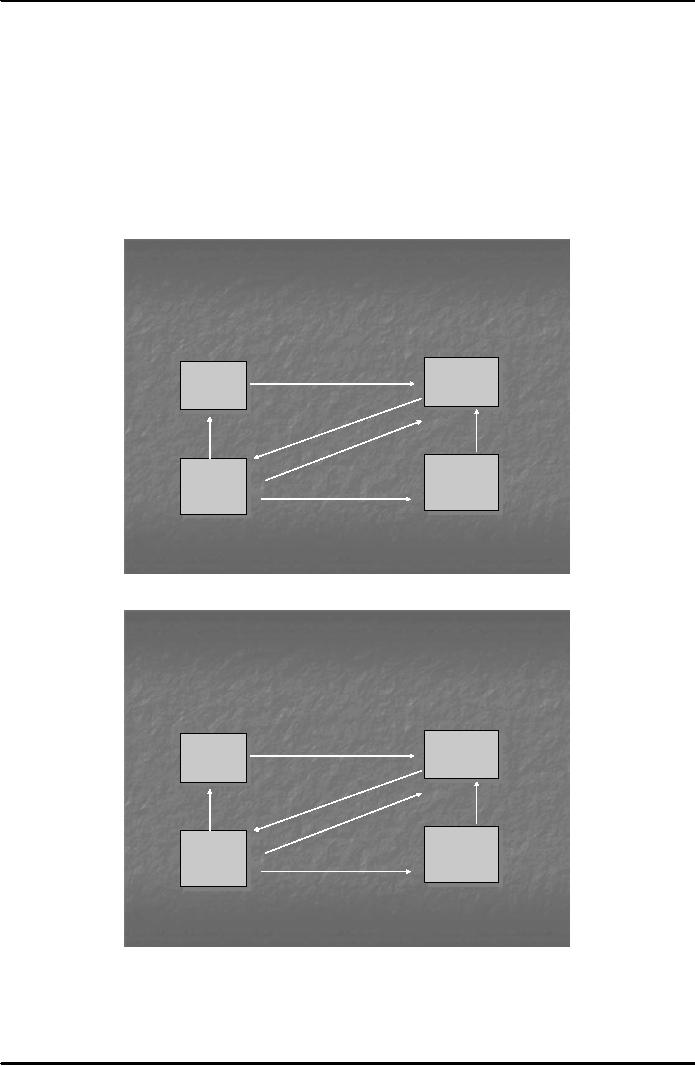

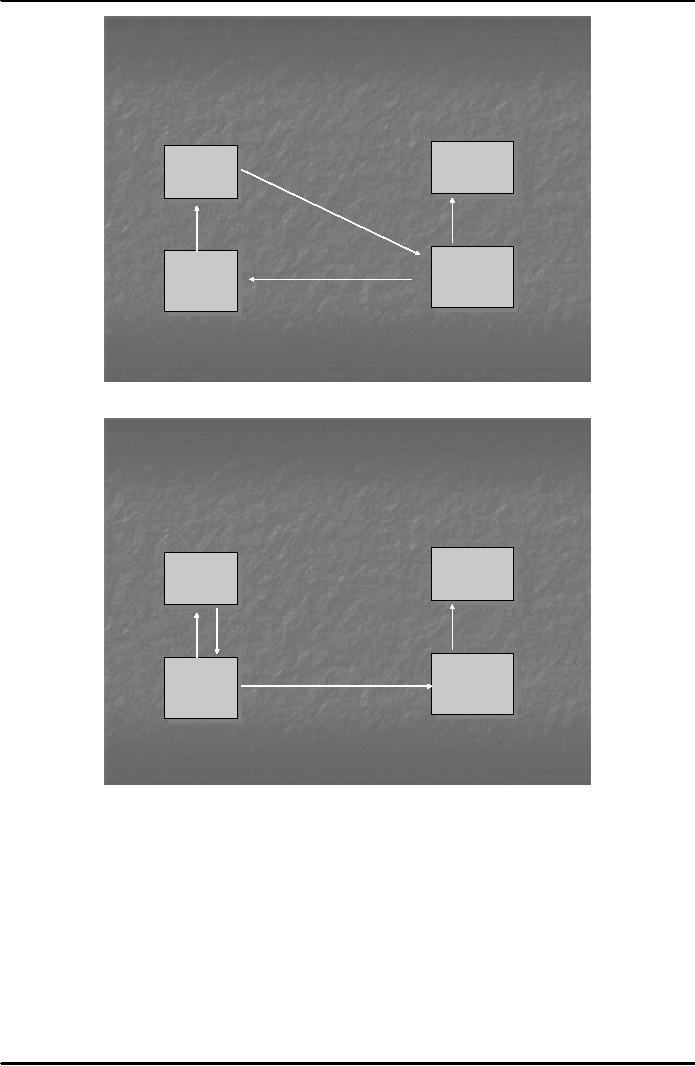

Depending

on the availability of processing infrastructure,

there are four different

scenarios for the

processing

of an electronic check. These

are shown below in figures

3-6. EFT stands for

`electronic

funds

transfer'.

Endorse

Write

1.

Pay

Paayee

P yee

Paayer

P yer

2.Cash

5.

Report

6.

Statement

3.

Notify

Paayeess

P yee'

'

Paayerss

P yer'

'

Baank

B nk

Baank

B nk

4.

EFT

Credit

Debit

Fig.

3

Endorse

Write

1.

Pay

Paayee

P yee

Paayer

P yer

2.Cash

5.

Report

6.

Statement

3.

Notify

Paayeess

P yee'

'

Paayerss

P yer'

'

Baank

B nk

Baank

B nk

4.

EFT

Credit

Debit

Fig.

4

114

E-COMMERCE

IT430

VU

Write

1.

Pay

Paayee

P yee

Paayer

P yer

3.

Accounts

4.

Statement

Receivable

Update

Paayeess

P yee'

'

Paayerss

P yer'

'

Baank

B nk

Baank

B nk

2.

Clear

Endorse &

Credit

Debit

Fig.

5

Write

Paayee

P yee

Paayer

P yer

3.

Accounts

4.

Statement

1.

Pay

Receivable

Update

Paayeess

P yee'

'

Paayerss

P yer'

'

Baank

B nk

Baank

B nk

2.

EFT

Credit

Debit

Fig.

6

115

Table of Contents:

- E-COMMERCE

- WHAT IS A NETWORK

- HOW MANY CLASS A, B, C NETWORKS AND HOSTS ARE POSSIBLE

- NETWORKING DEVICES

- BASICS OF HTML 1

- BASICS OF HTML 2

- TEXT BOXES, CHECK BOXES, RADIO BUTTONS

- FRAMES AND IMAGES IN HTML

- TAG ATTRIBUTES, SOUNDS FILES, ANIMATIONS

- STYLE SHEETS 1

- STYLE SHEETS 2

- SOME USEFUL STYLE SHEETS PROPERTIES

- JAVA SCRIPTING 1

- JAVA SCRIPTING 2

- JAVA SCRIPTING 3

- JAVA SCRIPTING AND XML

- CLIENT AND SERVER SIDE PROCESSING OF DATA

- APPLETS, CGI SCRIPTS

- MAINTAINING STATE IN A STATELESS SYSTEM

- INTEGRATION WITH ERP SYSTEMS

- FIREWALLS

- CRYPTOGRAPHY

- HASH FUNCTION AND MESSAGE DIGEST

- SYMMETRIC KEY ALGORITHMS

- VIRTUAL PIN PAYMENT SYSTEM

- E-CASH PAYMENT SYSTEM 1

- E-CASH PAYMENT SYSTEM 2

- SECURE SOCKET LAYER (SSL)

- E-BUSINESS: DISADVANTAGES OF E-BUSINESS

- E-BUSINESS REVENUE MODELS

- E-MAIL MARKETING

- CUSTOMER RELATIONSHIP MANAGEMENT (CRM)

- META INFORMATION

- DATA MINING

- CONFIDENCE AND SUPPORT

- ELECTRONIC DATA INTERCHANGE (EDI)

- PERSONAL FINANCE ONLINE

- SUPPLY CHAIN

- PORTER’S MODEL OF COMPETITIVE RIVALRY

- BARRIERS TO INTERNATIONAL E-COMMERCE

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 1

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 2

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 3

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 1

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 2