|

SYMMETRIC KEY ALGORITHMS |

| << HASH FUNCTION AND MESSAGE DIGEST |

| VIRTUAL PIN PAYMENT SYSTEM >> |

E-COMMERCE

IT430

VU

Lesson

24

SYMMETRIC

KEY ALGORITHMS

Cryptographic

algorithms are measured in terms of

key length. Following is the list of

some popular

symmetric

key algorithms:

DES

(Data Encryption Standard) 56

bits

IDEA

(International Data Encryption Algorithm

(IDEA) 128 bits

RC2

(block cipher) 1-2048 bits

RC4

(stream cipher) 1-2048 bits

Rinjdael

128-256 bits

Attacks

on Symmetric Key

Algorithms

Following

attacks have been reported on

symmetric key algorithms:

Key

Search Attacks

Cryptanalysis

System-based

Attacks

Key

Search (Brute Force) Attacks

In this type of

attack an attempt is made by the attacker

to decrypt the message with every

possible key.

Thus,

the greater the key length, the more

difficult it is to identify the

key.

Cryptanalysis

Encryption

algorithms can be defeated by using a

combination of sophisticated mathematics

and computing

power so

that many encrypted messages

can be deciphered without

knowing the key. Such type of an

attack

is

called cryptanalysis.

System-Based

Attacks

In it the

attack is made on the cryptographic

system that uses the cryptographic

algorithm without

actually

attacking the

algorithm itself.

Public

Key Algorithms

Following

is the list some popular

public key algorithms:

DSS

Digital Signature Standard

based on DSA (Digital

Standard Algorithm)

key

length is between 512-1024

bits

RSA

Elliptic

Curves

Attacks

on Public Key

Algorithms

Key

Search Attacks

The

public key and its

corresponding private key are

linked with each other

with the help of a

large

composite

number. These attacks attempt to derive the

private key from its

corresponding public key

using

that

number. According to an estimate 1024

bit RSA public key

may be factored due to fast

computers by

2020.

Note that both symmetric

and asymmetric algorithms are

based on different techniques. In

case of

108

E-COMMERCE

IT430

VU

asymmetric

algorithms the increase in key length

does not much increase the

difficulty level for the

attacker

as

compared to symmetric algorithms. Thus, a

128-bit RC2 symmetric key

may prove to be much

stronger

than a

1024 bit RSA asymmetric

public key.

Analytical

Attacks

Such

attacks use some fundamental

flaw in the mathematical problem on

which the encryption system

itself

is

based so as to break the

encryption.

Quantum

computing is the branch of computer

science that deals with the

development of cryptographic

algorithms. It

can also be used to find

flaws in the cryptographic system/algorithms and to

launch attacks.

Electronic

Payment Systems

Most

of the electronic payment systems on

internet use cryptography in one

way or the other to

ensure

confidentiality

and security of the payment

information. Some of the popular

payment systems on

internet

include the

credit-card based payment

systems, electronic checks, electronic

cash, micro-payment systems

(milicent, payword

etc.)

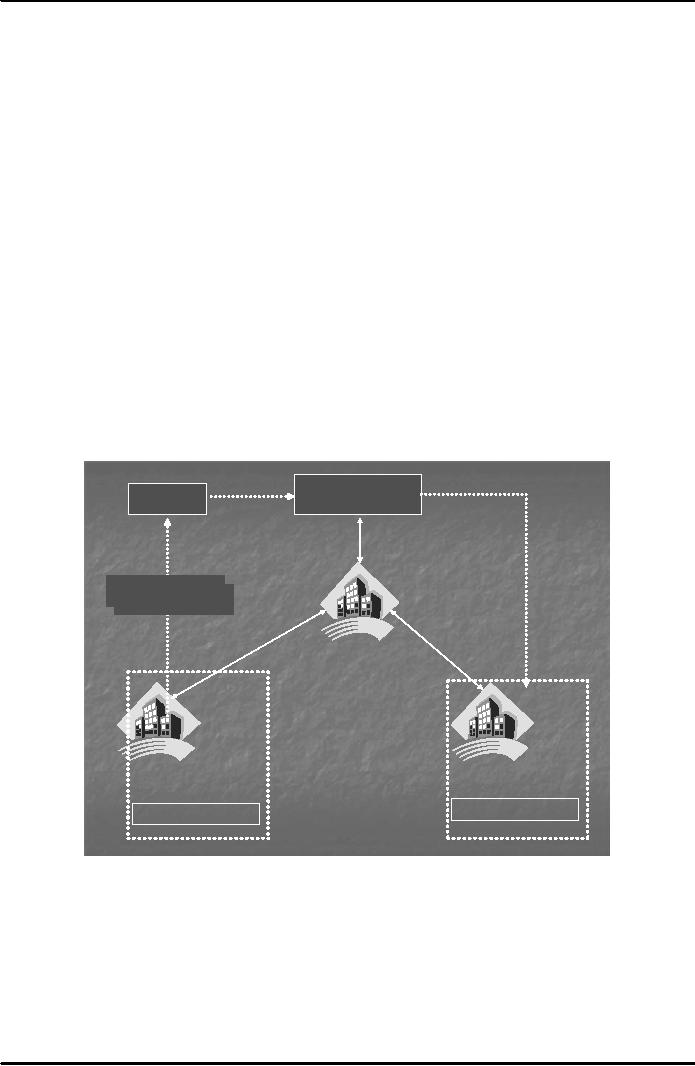

The

Process of Using Credit

Cards

It may

be useful to see how payment is

made through a credit card in the

traditional sense. Fig. 1

below

shows

the steps to be followed in this

regard:

Merchant

Card

Holder

2.

Show

Credit

Card

3.

Authorization

4.

Capture

1.Issue

Credit Card

1.Issue

Credit Card

5.

r

Pa

fe

ns

y

m

a

Tr

en

nt

t

ou

Re

Am

qu

Card

Brand

6.

es

t

Acquirer

Bank

Issuer

Bank

Merchant

Account

Cardholder

Account

Fig.

1

1. A

potential cardholder requests an issuing

bank in which the cardholder may have an

account,

the

issuance of a card brand (like

Visa or MasterCard). The

issuing bank approves (or

denies)

the application. If

approved, a plastic card is physically

delivered to the customer's address

by

mail.

The card is activated as

soon as the cardholder calls the bank for

initiation and signs

the

back

of the card.

2. The

cardholder shows the card to a merchant

whenever he or she needs to

pay for a product or

service.

3. The

merchant then asks for

approval from the brand company (Visa

etc.) and the transaction

is

paid by credit.

The merchant keeps a sales

slip.

109

E-COMMERCE

IT430

VU

4. The

merchant sends the slip to the acquirer

bank and pays a fee for the

service. This is called

a

capturing

process.

5. The

acquirer bank requests the brand to clear

for the credit amount and gets

paid.

6.

Then the brand asks for

clearance to the issuer bank. The amount

is transferred from issuer

to

brand.

The same amount is deducted

from the cardholder's account in the

issuing bank.

Note

that in case of a credit card the

issuer bank charges interest

from the client at a specified

rate on the

amount

lent. On the other hand, in

case of a debit card no such

interest is payable since the

customer uses

his/her

own money in that

case.

Virtual

PIN Payment System

It is

one of the earliest credit card-based

systems launched for the

internet in 1994 by a company;

First

Virtual

Holdings, Inc. Virtual PIN

system does not involve the

use of encryption. Payment is made

through

the credit

card in this system. The objective

was to allow the selling of low-value

information items

without

the

use of any special client

software or hardware.

Both

merchants and buyers are

required to register with First Virtual

(FV). A buyer registering with

FV

forwards

his or her credit card

details and email address to

FV and in exchange receives a

pass phrase called,

Virtual

PIN. Buyer makes a telephone

call to FV to provide his/her credit

card number. FV establishes a

link

between the Virtual PIN and the credit

card number without using the credit

card number on the

network.

A Merchant goes through a

similar registration process. He provides

his bank details to FV and

is

given a

merchant Virtual PIN. The

merchant can now request to

process payments from

registered FV

customers.

The transfer takes place

with the help of Automated

Clearing House (ACH) service.

Note that

an ACH

is a centralized system to which

different banks are electronically

connected forming a network

for

clearing

payment requests. At the end the

payment proceeds from the credit

card issuer bank to the

account

of the

merchant with acquirer bank

(merchant's bank) through ACH, after FV

deducts a per-transaction

charge

for its services.

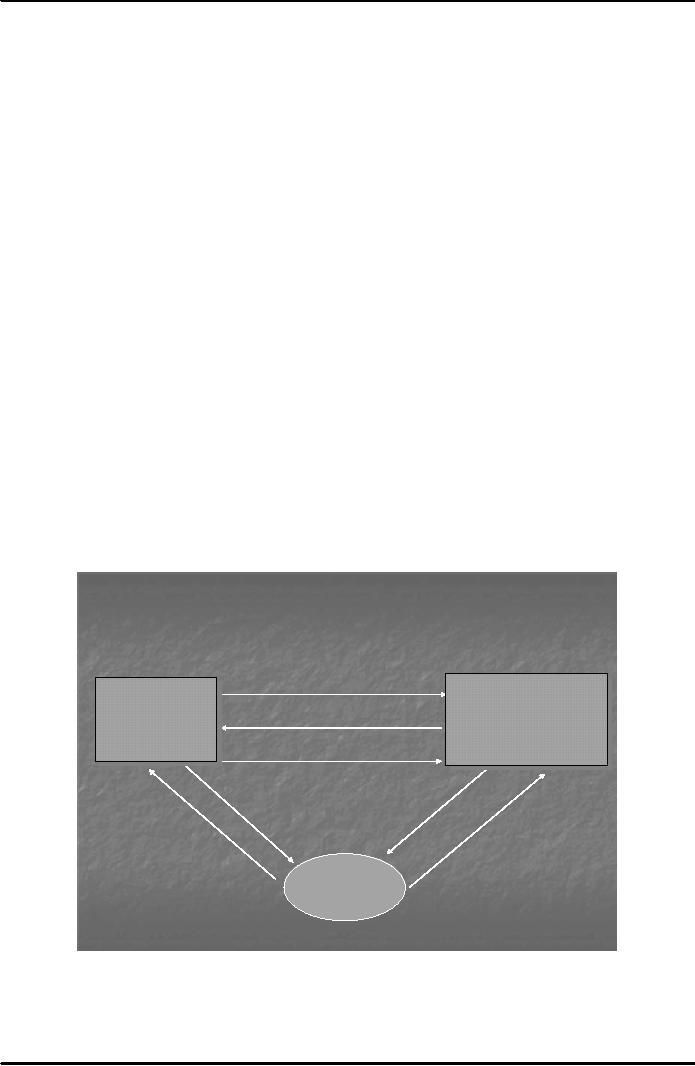

Fig. 2

below shows the working of

Virtual PIN payment

system.

Buying with First

Virtual

2. Account ID

Valid?

FirrstVirrtualIInternet

Fist Vitual

nternet

PaymenttSysstem

Paymen Sy

tem

Web

Serrver

Web

Sever

3. Account

OK!

Serrver

Sever

((Sellilng

Sel

ing

Goodss)

Good

)

5. Transaction

Details

4.

Information

Goods

6.

Satisfied?

1. Account

ID

7.

Accept/Reject or

Fraud

Indication

Buyer

Fig.

2

A buyer

browses the web server where

FV registered merchant is selling

goods. The buyer is asked to

enter

his/her

Virtual PIN by the merchant site

(step

1). Merchant

queries the FV Internet Payment

System

Server

(FVIPSS) to confirm Virtual PIN (step

2). If

Virtual PIN is not blacklisted (step

3), the

merchant

110

E-COMMERCE

IT430

VU

may

acknowledge this fact to the buyer by email

and sends the goods, and

also sends transaction

details to

FV (steps

4 & 5). FVIPSS or simply

FV server sends email to the buyer if the

goods were

satisfactory

(step

6). There

are three possible answers

to that (step

7). If the

answer is "accept" then the

payment

proceeds,

in case the answer is "reject" it

means that either the goods

have not been received or

the buyer is

not

satisfied with the quality of

goods. Then the payment is

not made to the merchant. If the

answer

indicates

"fraud" it means that the

goods were never ordered. In

such an eventuality the FVIPSS

immediately

blacklists Virtual PIN so that it cannot

be used in the future.

Time

period may be a few minutes to a

few days for answering the

email in step no. 6 above,

otherwise

FV

shall proceed to arrange the

payment. If a Virtual PIN has

been stolen and the buyer

does not

indicate

fraud within the time period

for answering the said email

the bogus transactions are

possible

before the

Pin is finally blacklisted. A

stolen credit card number can

also be used to set up

Virtual PIN

associated

with an email address

controlled by the attacker to carry

out bogus

transactions.

111

Table of Contents:

- E-COMMERCE

- WHAT IS A NETWORK

- HOW MANY CLASS A, B, C NETWORKS AND HOSTS ARE POSSIBLE

- NETWORKING DEVICES

- BASICS OF HTML 1

- BASICS OF HTML 2

- TEXT BOXES, CHECK BOXES, RADIO BUTTONS

- FRAMES AND IMAGES IN HTML

- TAG ATTRIBUTES, SOUNDS FILES, ANIMATIONS

- STYLE SHEETS 1

- STYLE SHEETS 2

- SOME USEFUL STYLE SHEETS PROPERTIES

- JAVA SCRIPTING 1

- JAVA SCRIPTING 2

- JAVA SCRIPTING 3

- JAVA SCRIPTING AND XML

- CLIENT AND SERVER SIDE PROCESSING OF DATA

- APPLETS, CGI SCRIPTS

- MAINTAINING STATE IN A STATELESS SYSTEM

- INTEGRATION WITH ERP SYSTEMS

- FIREWALLS

- CRYPTOGRAPHY

- HASH FUNCTION AND MESSAGE DIGEST

- SYMMETRIC KEY ALGORITHMS

- VIRTUAL PIN PAYMENT SYSTEM

- E-CASH PAYMENT SYSTEM 1

- E-CASH PAYMENT SYSTEM 2

- SECURE SOCKET LAYER (SSL)

- E-BUSINESS: DISADVANTAGES OF E-BUSINESS

- E-BUSINESS REVENUE MODELS

- E-MAIL MARKETING

- CUSTOMER RELATIONSHIP MANAGEMENT (CRM)

- META INFORMATION

- DATA MINING

- CONFIDENCE AND SUPPORT

- ELECTRONIC DATA INTERCHANGE (EDI)

- PERSONAL FINANCE ONLINE

- SUPPLY CHAIN

- PORTER’S MODEL OF COMPETITIVE RIVALRY

- BARRIERS TO INTERNATIONAL E-COMMERCE

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 1

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 2

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 3

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 1

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 2