|

Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff |

| << Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES |

| Bundling:Consumption Decisions When Products are Bundled >> |

Microeconomics

ECO402

VU

Lesson

36

Airline

Fares

Differences

in elasticities imply that

some customers will pay a

higher fare than

others.

Business

travelers have few choices

and their demand is less

elastic.

Casual

travelers have choices and

are more price

sensitive.

Elasticities

of Demand for Air

Travel

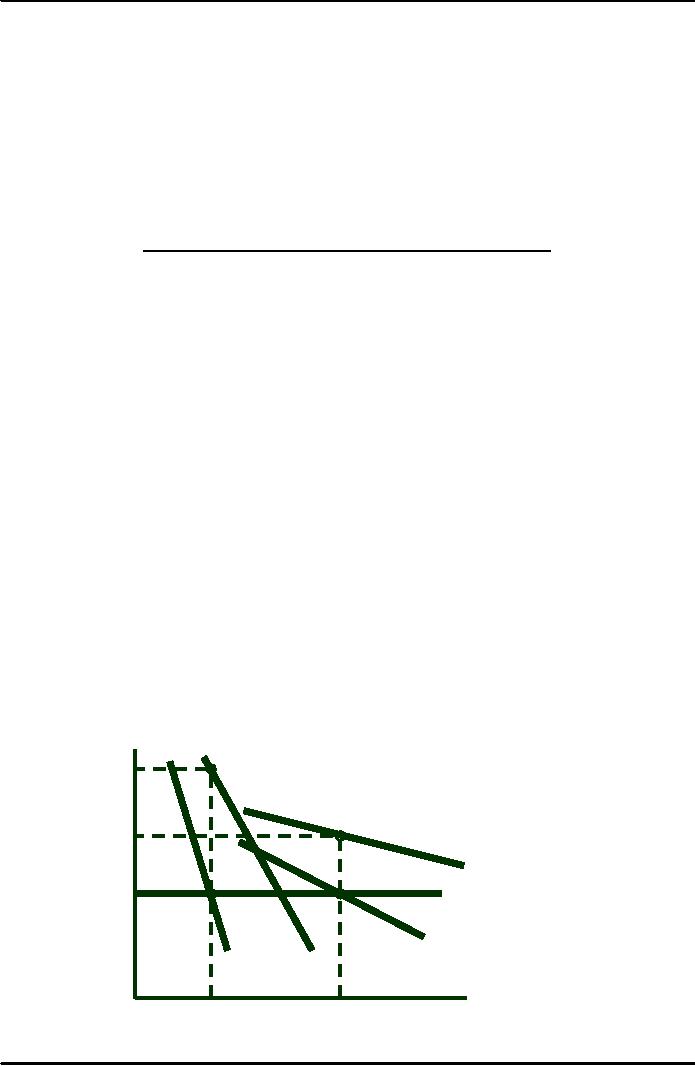

Elasticity

First-Class

Economy

Plus Economy

Price

-0.3

-0.4

-0.9

Income

1.2

1.2

1.8

The

airlines separate the market

by setting various restrictions on

the tickets.

Less

expensive: notice, stay over

the weekend, no

refund

Most

expensive: no restrictions

Intertemporal

Price Discrimination and

Peak-Load Pricing

Separating

the Market With

Time

Initial

release of a product, the

demand is inelastic

Book

Movie

Computer

Once this

market has yielded a maximum

profit, firms lower the

price to appeal to a

general

market with a more elastic

demand

Paper

back books

Dollar

Movies

Discount

computers

Consumers

are divided

$/Q

into

groups over

Over

time, demand

time.Initially,

demand becomes more

elastic

P1

is

less elastic resulting and

price is reduced

in

a price of P1 .

to

appeal to the mass

market.

P2

D2 =

AR2

AC

= MC

MR2

D1 =

AR1

MR1

Q1

Q2

Quantity

167

Microeconomics

ECO402

VU

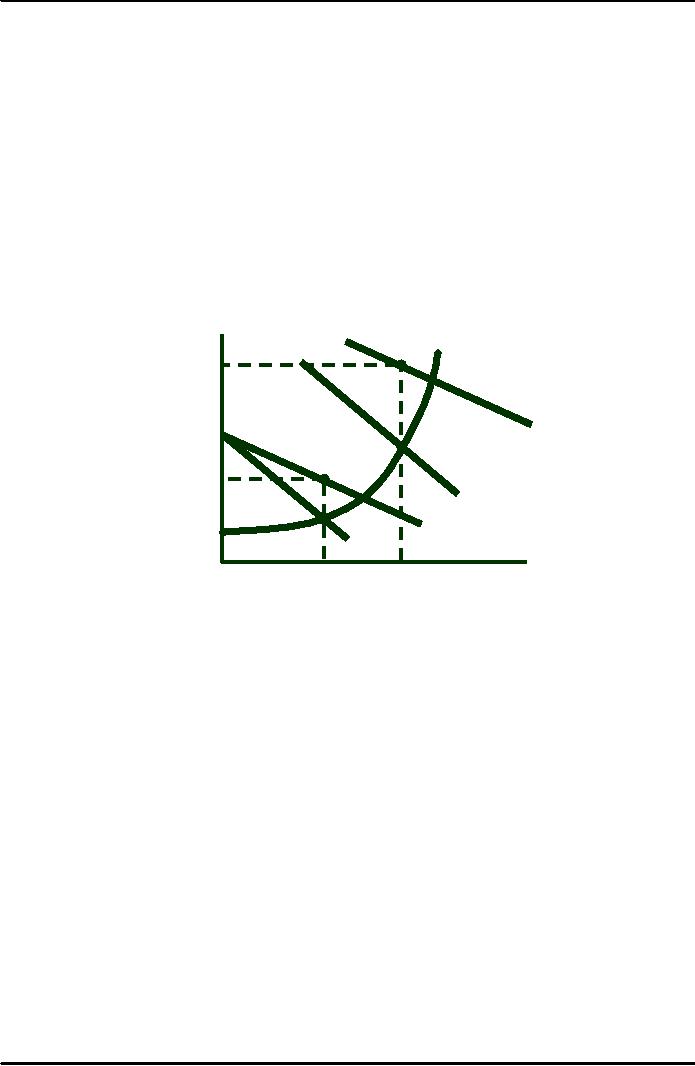

Peak-Load

Pricing

Demand for

some products may peak at

particular times.

Rush

hour traffic

Electricity

- summer season

Restaurants

on weekends

Capacity

restraints will also

increase MC.

Increased MR

and MC would indicate a

higher price.

MR is not

equal for each market

because one market does

not impact the other

market.

$/Q

MC

Peak-load

price

= P1 .

P1

D1 =

AR1

Off-

load

price

= P2 .

P2

MR1

D2 =

AR2

MR2

Q

Q

Quantity

How

to Price a Best Selling

Novel

What

Do You Think?

1)

How would you arrive at

the price for the

initial release of the

hardbound

edition

of a book?

2)

How long do you wait to

release the paperback

edition? Could the

popularity

of the book impact your

decision?

3)

How do you determine the

price for the paperback

edition?

The

Two-Part Tariff

The

purchase of some products

and services can be

separated into two

decisions, and

therefore,

two prices.

Examples

1)Amusement

Park

Pay

to enter

Pay

for rides and food

within the park

168

Microeconomics

ECO402

VU

2)Tennis

Club

Pay

to join

Pay

to play

3)

Safety Razor

Pay

for razor

Pay

for blades

4)

Polaroid Film

Pay

for the camera

Pay

for the film

Pricing

decision is setting the

entry fee (T) and

the usage fee

(P).

Choosing

the trade-off between

free-entry and high use

prices or high-entry and

zero use

prices.

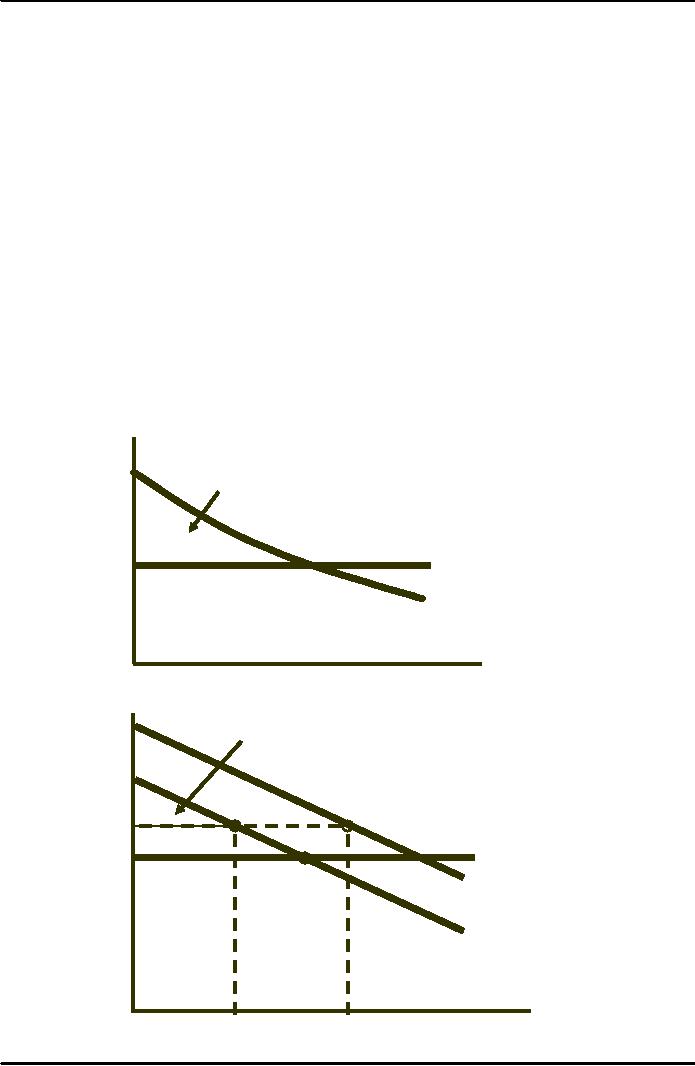

Two-Part

Tariff with a Single

Consumer

$/Q

Usage

price P*is

set

where

T

MC

= D. Entry price T*

is

equal to the entire

consumer

surplus.

M

P

D

Quantity

The

price, P*,

will

be

T*

$/Q

greater

than MC. Set T*

at

the surplus value of D2.

ö

= 2T * +

(P* -

MC)

x(Q1 +

Q2 )

A

ö

more

than twice ABC

P*

MC

B

C

D1 = consumer

1

D2 = consumer

2

Quantity

Q2

Q1

169

Microeconomics

ECO402

VU

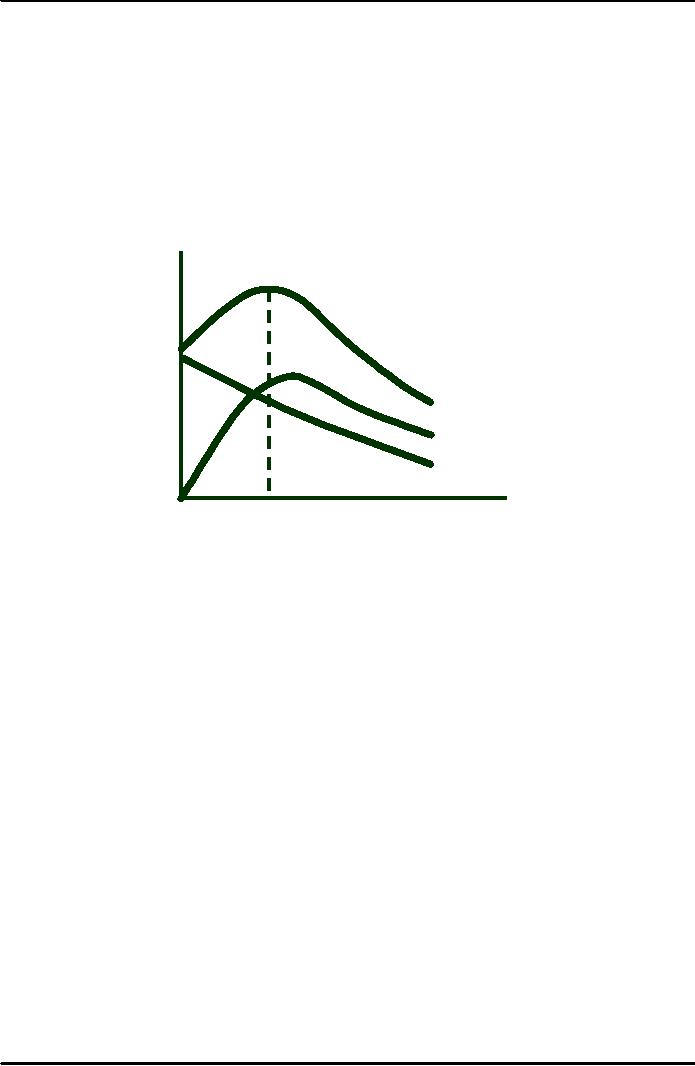

Two-Part

Tariff with Two

Consumers

The

Two-Part Tariff With Many

Different Consumers

No exact

way to determine P* and

T*.

Must

consider the trade-off

between the entry fee

T*

and the use fee

P*.

Low

entry fee: High sales

and falling profit with

lower price and more

entrants.

To find

optimum combination, choose

several combinations of P,T.

Choose

the combination that

maximizes profit.

ö

=öa

+ös

=n(T)T

+(P-MCQ(n)

)

Profit

n=entrants

Total

profit is the sum of

the

profit

from the entry fee

and

the

profit from sales.

Both

depend

on T.

ö

Total

öa: entry

fee

öS:

sales

T

T*

Rule

of Thumb

Similar

demand: Choose P

close

to MC and high T

Dissimilar

demand: Choose high

P

and

low T.

Two-Part

Tariff With A Twist

Entry

price (T)

entitles

the buyer to a certain

number of free units

Razors

with several blades

Amusement

parks with some

tokens

On-line

with free time

170

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor