|

A Competitive Firm Incurring Losses:Industry Supply in Short Run |

| << Perfectly Competitive Markets:Choosing Output in Short Run |

| Elasticity of Market Supply:Producer Surplus for a Market >> |

Microeconomics

ECO402

VU

Lesson

23

A

Competitive Firm Incurring

Losses

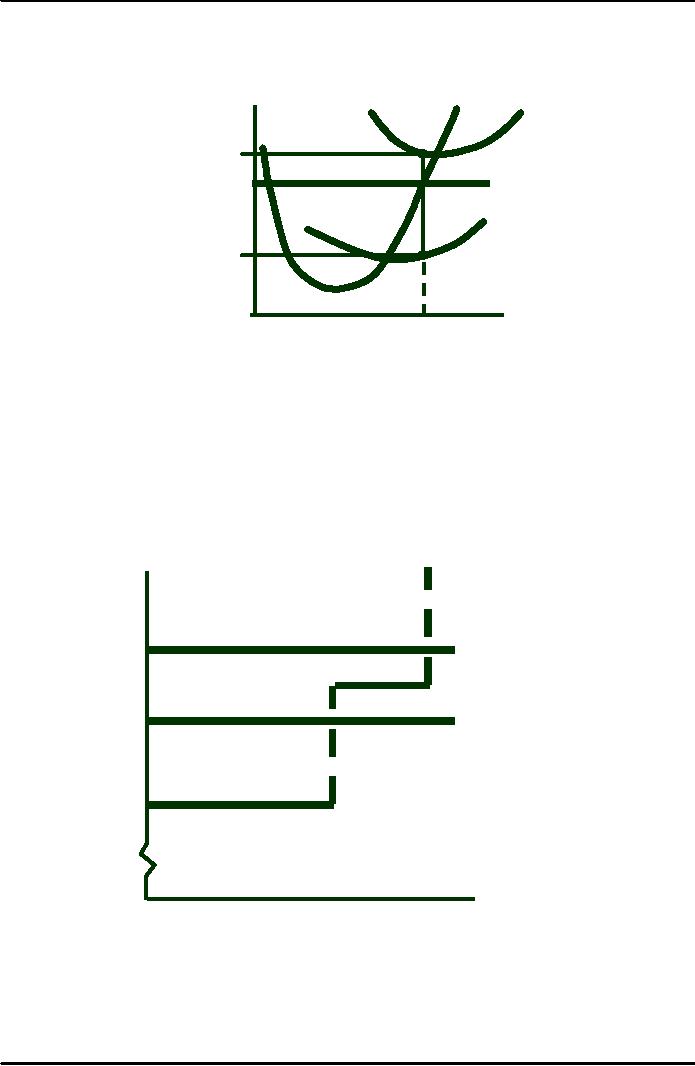

M

AT

Price

($

per

unit)

B

C

P=

D

A

*

At

q :

MR = MC

and

P < ATC

AV

*

Losses

= P- AC) x q

or

ABCD

F

Would

this producer

E

continue

to produce

with

a loss?

Output

q

*

Choosing

Output in Short

Run

Summary

of Production Decisions

Profit is

maximized when MC

= MR

If P

> ATC the

firm is making profits.

If AVC

< P < ATC the

firm should produce at a

loss.

If P

< AVC < ATC the

firm should shut-down.

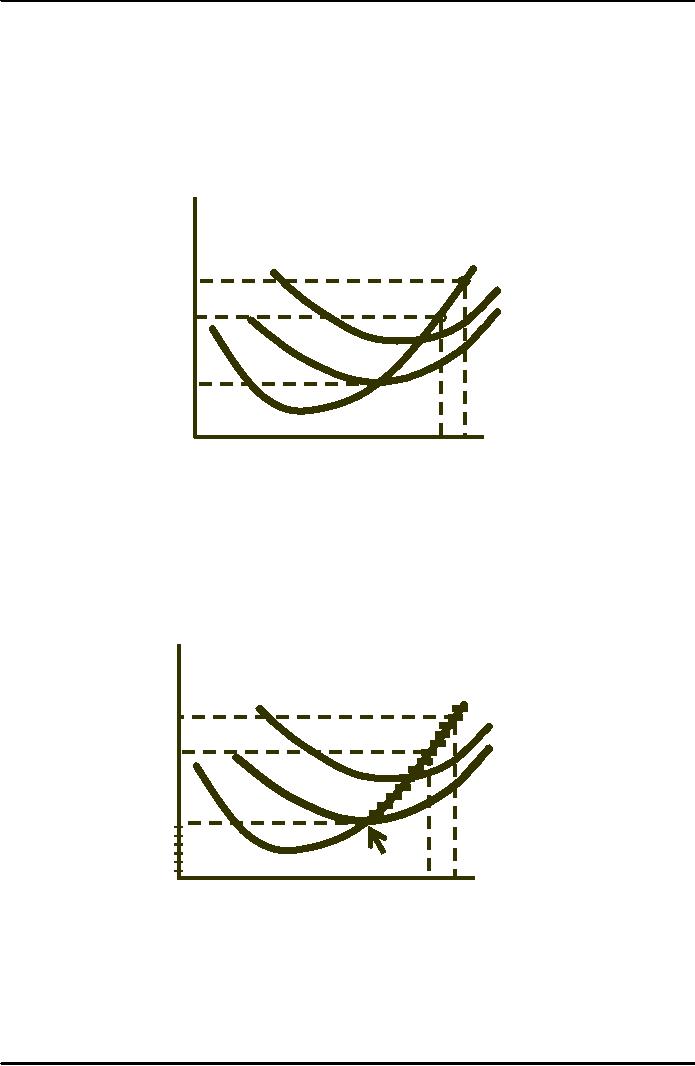

The

Short-Run Output of an Aluminum

Smelting Plant

Cost

Observations

∑Price between $1140 &

$1300: q

(dollars

per item)

=

600

∑Price > $1300:

q

=

900

1400

∑Price < $1140:

q

= 0

P

1300

P

1200

Question

1140

Should

the firm stay in

business

when

P

<

$1140?

1100

Output

0

(tons

per day)

300

600

900

Some

Cost Considerations for

Managers

Three

guidelines for estimating

marginal cost:

117

Microeconomics

ECO402

VU

1)

Average variable cost should

not be used as a substitute

for marginal cost.

2)

A single item on a firm's

accounting ledger may have

two components, only one

of

which

involves marginal

cost.

3)

All opportunity cost should

be included in determining marginal

cost.

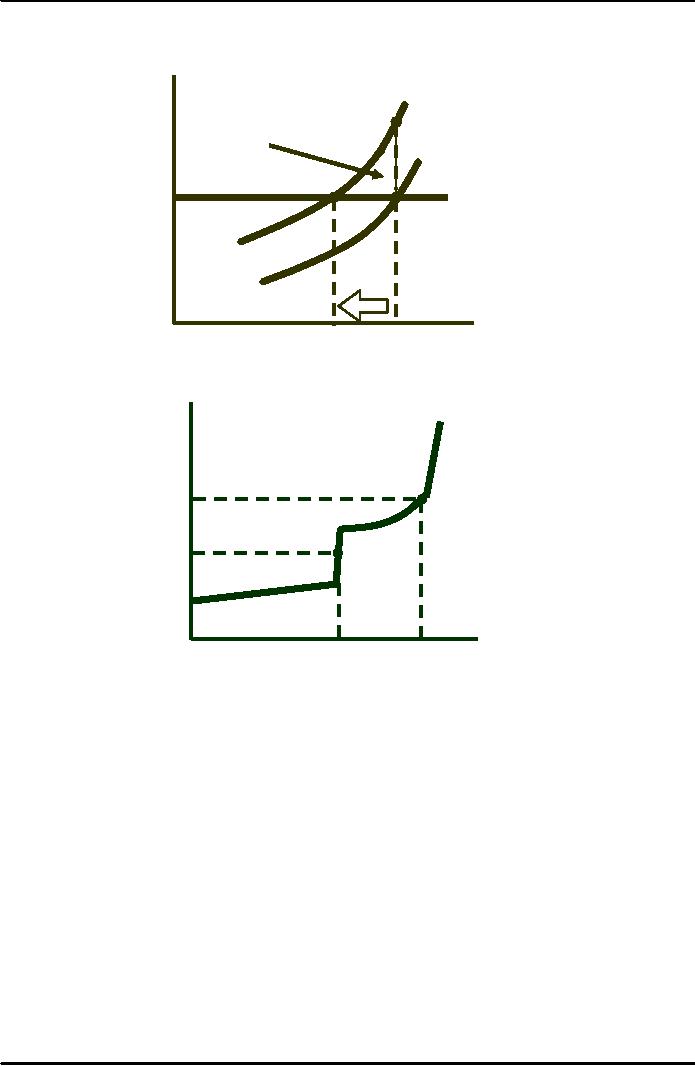

A

Competitive Firm's Short-Run

Supply Curve

Price

($

per

The

firm chooses the output

level

unit)

where

MR = MC, as long as the

firm

is

able to cover its variable

cost of

MC

production.

ATC

P2

AVC

P1

What

happens

P

= AVC

if

P < AVC?

Output

q2

q1

Observations:

P

= MR

MR

= MC

P

= MC

Supply

is the amount of output for

every possible price.

Therefore:

If P = P1,

then q = q1

If P = P2,

then q = q2

Price

S

= MC above AVC

($

per

unit)

MC

ATC

P2

AVC

P1

P

= AVC

Shut-down

Output

q2

q1

Observations:

Supply is

upward sloping due to

diminishing returns.

Higher price

compensates the firm for

higher cost of additional

output and increases

total

profit because it applies to

all units.

Firm's

Response to an Input Price

Change

118

Microeconomics

ECO402

VU

When the

price of a firm's product

changes, the firm changes

its output level, so that

the

marginal

cost of production remains

equal to the price.

Price

MC2

($

per

Input

cost

unit)

Savings

to the firm

increases

from

reducing output

MC1 and

MC shifts

to

MC2

and

q falls

to q2.

$5

q

q2

Output

The

Short-Run Production of Petroleum

Products

The

MC of producing a mix

Cost

27

SMC

of

petroleum products

from

($

per

crude

oil increases sharply

at

barrel)

several

levels of output as

How

much would

the

refinery shifts from

one

be

produced if

26

processing

unit to another.

P

= $23?

P

=

$24-$25?

25

24

Output

23

(barrels/day)

8,000

9,000

10,000

11,000

Stepped

SMC indicates a different production

(cost) process at various

capacity levels.

Observation:

With a stepped

MC function, small changes in

price may not trigger a

change in output.

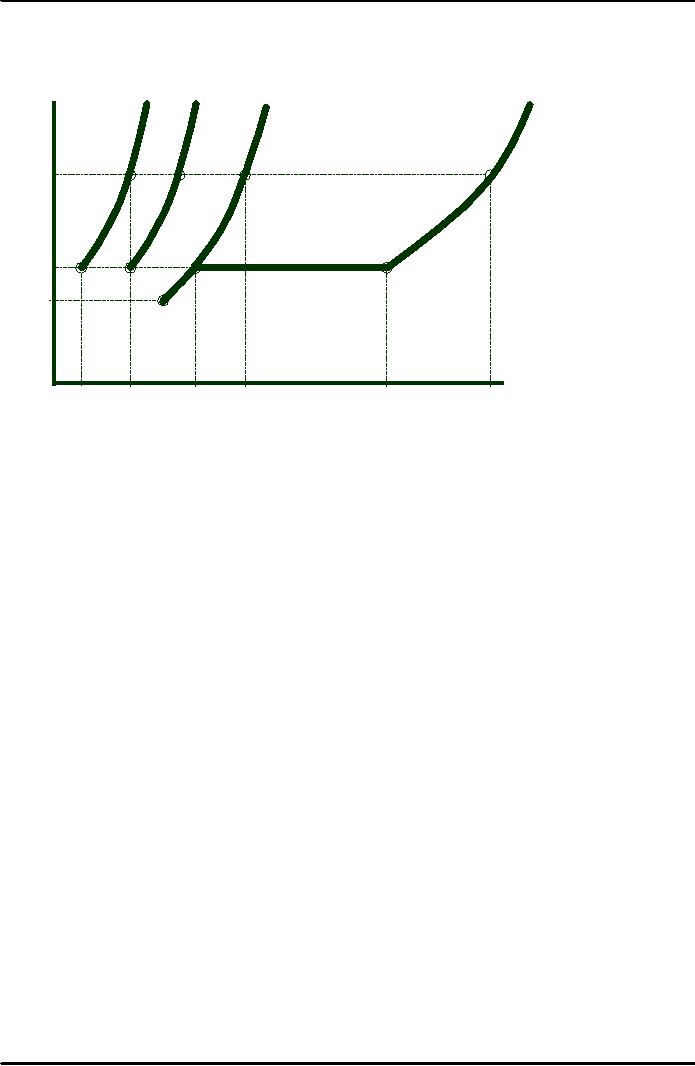

The

short-run market supply

curve shows the amount of

output that the industry

will

produce

in the short-run for every

possible price.

Consider,

for simplicity, a competitive

market with three

firms:

119

Microeconomics

ECO402

VU

Industry

Supply in Short

Run

The

short-run

$

per

MC1

MC2

MC3

S

industry

supply curve

unit

is

the horizontal

summation

of the supply

curves

of the firms.

P3

P2

P1

Question:

If increasing

output

raises input

costs,

what impact

would

it have on

market

supply?

Quantity

21

0

2

4 5

7 8

10

15

120

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor